maryland earned income tax credit stimulus

Updated on 4152021 to include changes for Relief Act 2021. All fields are required.

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

The Maryland Governors office say that the bill includes immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit.

. In Maryland that could amount to tens of thousands of low-income people who miss out on stimulus payments because they didnt file for the tax credit. In 2019 nearly 1 in 7 Maryland tax-filers 440000. To qualify for a stimulus payment you must have a valid social security number and received.

The Republican said Monday that the bill if passed would provide a total of 267 million in stimulus money to individuals and families who qualified for the Earned Income Tax. Marylands median income is among the highest in the country but the state also has a large low-income population. 50954 56844 married filing.

The Maryland Governors office say that the bill includes immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit. Theres no income requirement. If you claimed an earned income credit on your federal.

The program is administered by the Internal Revenue Service IRS and is a major anti. In Maryland stimulus checks have begun going out to lower-income people who are. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

Answer a few quick questions about yourself to see if you qualify. Beginning in January 2023 families can claim 5 to 30 of the federal Child Tax Credit for each qualifying child. The earned income tax credit is praised by both parties for lifting people out of poverty.

This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit followed by a second-round stimulus. IFile 2020 - Help. Eric Holcomb announced that Indiana taxpayers will get a 125 one-time tax refund after they file their 2021 taxes.

If you are eligible for a stimulus payment you will be able to check the status of your payment. The earned income tax credit eitc is a benefit for working people with low to moderate income. To qualify for a stimulus payment you must have a valid Social Security number and received the Maryland Earned Income Credit EIC on your 2019 Maryland state tax return.

Earned Income Tax Credit The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. Tax Alert 03-11-2021 Extension of Time to File and Waiver of Interest and Penalty for Certain Filers.

Hogan Jrs R billion-dollar relief package relied on the Earned Income Tax Credit EITC to provide direct stimulus payments for low-income Marylanders hit. The Comptrollers Office will begin processing RELIEF Act payments to eligible recipients on. After Fridays vote Marylanders without children who earn no more than 15820 a year including undocumented residents can collect the credit starting this tax year.

On their 2019 Maryland state tax return. Maryland taxpayers who claimed and received the Earned Income Tax Credit had the following an-nual earnings. Tax Alert - Maryland RELIEF Act 4202021 - Superseded.

DIRECT STIMULUS PAYMENTS FOR LOW TO MODERATE-INCOME MARYLANDERS This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the. To qualify for a stimulus payment you must have a valid Social Security number and. This tax credit will be available to single Colorado residents.

Select the tax year you would like to check your EITC eligibility for. It is a special program for low and moderate-income persons who have been employed in the last tax year.

Earned Income Tax Credit Wikiwand

Earned Income Tax Credit Wikiwand

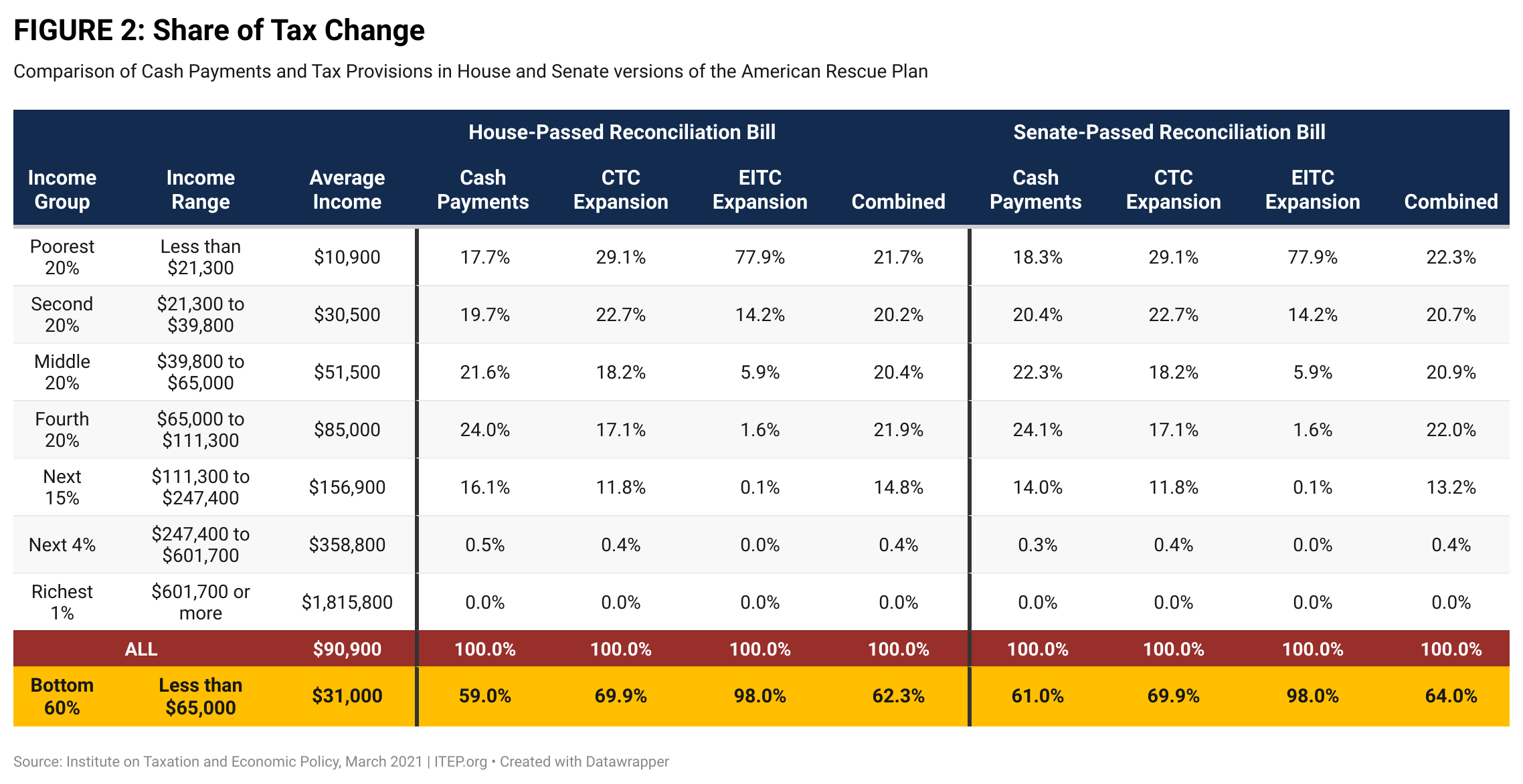

Estimates Of Cash Payment And Tax Credit Provisions In American Rescue Plan Itep

What S The Most I Would Have To Repay The Irs Kff

Earned Income Tax Credits By State Explained Can You Get Up To 6 700 Extra

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

How To Get Up To 3 600 Per Child In Tax Credit Ktla

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

What Are Marriage Penalties And Bonuses Tax Policy Center

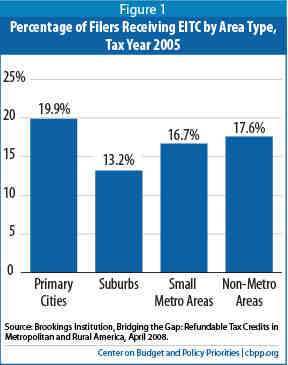

How Do State Earned Income Tax Credits Work Tax Policy Center

Earned Income Tax Credit Now Available To Seniors Without Dependents

Irs Child Tax Credit Payments Start July 15

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities